12 Websites That Gives Urgent Loan In Nigeria Without Collateral

Acquiring a loan can be a significant financial tool for both individuals and businesses to meet their obligations. However, the mandatory requirement of collateral frequently presents a formidable challenge.

In Nigeria, not everyone has assets they can use as security for a loan. Thankfully, there are several online platforms that provide quick loans without the need for collateral, making it easier for individuals and business owners to access much-needed funds.

Why Loans Without Collateral Are Important

The absence of collateral requirements for loans is particularly beneficial in Nigeria due to the high number of people and businesses that do not possess assets that can serve as security. This development has opened up opportunities for many to secure funds they otherwise would not have been able to obtain.

These online lenders typically evaluate an applicant’s creditworthiness and repayment capability using various algorithms and technologies. This helps them determine the loan amount and terms suitable for the borrower.

Below is a detailed look at 12 websites that offer urgent loan in Nigeria without collateral in 2024.

1. GroFin

GroFin provides funding to Small and Medium Enterprises (SMEs) throughout Africa and the Middle East. If you have a viable business and are looking to expand, GroFin can provide loans ranging from $100,000 to $1.5 million. Businesses that meet their criteria can apply online through their website.

2. SMEDAN

SMEDAN (Small and Medium Enterprises Development Agency of Nigeria) is a government initiative aimed at promoting entrepreneurship and providing capital to start or expand businesses. Apart from funding, SMEDAN also offers training and support to business owners. Interested applicants can access their online application portal.

3. Lidya.co

Lidya is a digital service that grants unsecured loans to small and medium enterprises, with loan amounts ranging from $500 to $15,000. They use technology and algorithms to assess risk, enabling them to offer financial products at a lower cost.

4. Aella Credit

Aella Credit focuses on providing financing to individuals, particularly through employee lending and empowerment. They use a proprietary credit scoring algorithm based on social and demographic factors, as well as debt-to-income ratio, to determine creditworthiness. This platform offers quick and affordable loans without the need for extensive paperwork.

5. Zedvance

Zedvance is a consumer finance company that provides loans to individuals, especially salary earners. With Zedvance, you can access up to 3 million Naira, with the money available in under 24 hours. This platform is particularly useful for salary earners who also have side businesses and need funds to support their ventures.

6. Paylater

Paylater is an online lending service offering short-term loans to both individuals and small businesses, aimed at covering unforeseen expenses or urgent financial needs. Applicants can access up to 500,000 Naira without collateral, with funds typically disbursed within 1 to 3 business days.

7. KiaKia.co

KiaKia is a digital lender that extends loans to individuals and small and medium enterprises (SMEs) without necessitating credit information. They utilize psychometry, big data, machine learning, and digital forensics to evaluate credit scores and assess risk. The name “KiaKia” translates to “Fast Fast” in a Nigerian language, reflecting the quick and efficient nature of their services.

8. OneFi

OneFi, formerly known as One Credit, offers short-term consumer loans to credit-worthy individuals. Their repayment cycle ranges from 3 to 6 months, with loan amounts up to N200,000 or more. This platform is designed to offer financial solutions to individuals with limited access to conventional banking services.

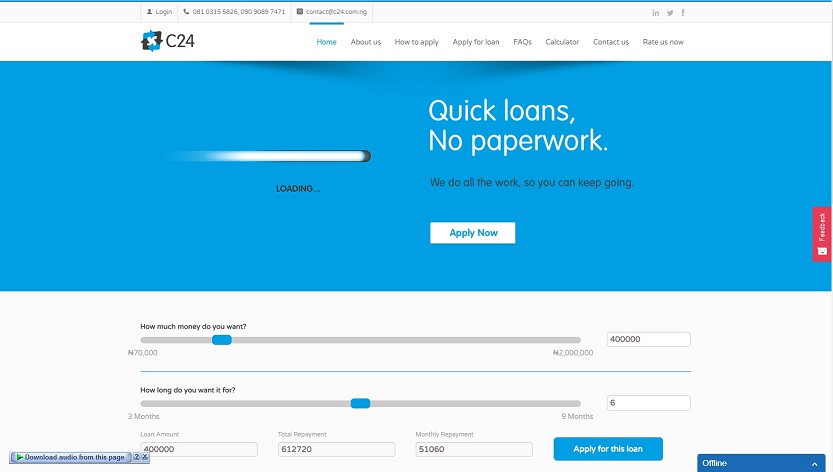

9. C24

C24 Limited is a microfinance institution that provides quick cash loans to help individuals seize opportunities around them. Their online process is optimized for efficiency, ensuring that applicants can avoid the usual stress associated with loan applications.

10. QuickCheck

QuickCheck uses mobile technology to provide loans to individuals and small businesses. Users can access loans up to 30,000 Naira without collateral for either 15 or 30 days. The platform aims to provide quick and hassle-free financial solutions.

11. Specta

Specta provides loans up to 5 million Naira in a single transaction, processed in just 5 minutes, with no need for collateral, paperwork, or visiting an office. They have two main products: MySpecta for individual loans and Specta4Business for corporate and business loans.

12. Fast Credit

FastCredit offers business loans to micro, small, and medium enterprises to foster growth.. They also offer ‘all-purpose’ cash loans to employees in various sectors, such as banking, telecommunications, and FMCGs, to meet urgent consumer needs. These loans are usually secured by guarantors and have a maximum term of 6 months..

Conclusion

In Nigeria, the availability of quick, collateral-free loans through these online platforms has significantly eased the process of accessing funds for individuals and small businesses.

These loans not only provide immediate financial relief but also support long-term business growth and personal financial stability. By leveraging technology, these lenders have simplified the application process, making it more accessible and efficient for everyone in need of financial assistance.