Which Loan App Is The Best In Nigeria?

The demand for quick and convenient loans in Nigeria has driven the popularity of digital lending apps. These platforms offer an accessible alternative to traditional financial institutions, providing loans with low-interest rates, no collateral, and rapid disbursement.

With over 118 digital lending companies in Nigeria, it’s crucial to understand their terms and conditions before choosing one. This article explores some of the best loan apps in Nigeria, focusing on their features, interest rates, and application processes.

Overview of Top Loan Apps in Nigeria

1. Branch

Branch is a leading loan app in Nigeria with over 10 million downloads and a 4.5-star rating on the Google Play Store. It offers a variety of financial services, including instant loans, money transfers, bill payments, airtime top-ups, and investments.

Key Features:

- Loans: Up to ₦1,000,000 with flexible repayment terms.

- Money Transfers: Free transfers within the app.

- Bill Payments: Pay for utilities and services directly.

- Airtime & Data Top-ups: Convenient in-app purchases.

- Investments: Earn up to 15% per annum.

Loan Details:

- Amount: ₦2,000 to ₦500,000

- Tenure: 62 days to 1 year

- APR: 34% to 271%

- Monthly Interest: 3% to 23%

Application Process:

- Download the Branch app on Android.

- Sign up and choose the “Loans” option.

- Enter your phone number and mobile money account details.

- Apply for the eligible amount.

- Receive funds within minutes.

2. FairMoney

FairMoney is a microfinance bank licensed by the Central Bank of Nigeria (CBN) and insured by the NDIC. It offers both personal and business loans, savings accounts, investments, and bill payment services. The app has over 10 million downloads and is known for quick loan disbursements without collateral.

Key Features:

- Personal Loans: Up to ₦3,000,000.

- Business Loans: Up to ₦5,000,000.

- FairSave: Daily interest on savings.

- FairLock: Fixed-term investments up to 24% interest.

- Bank Account Services: Free transfers, bill payments, and ATM card cashback rewards.

Loan Details:

- Amount: Variable up to ₦3,000,000

- Tenure: Flexible repayment terms

- APR: Not specified

Application Process:

- Install the FairMoney app from the Google Play Store.

- Create an account with your phone number.

- Follow the instructions to apply for the eligible loan amount.

- Receive funds within five minutes.

3. Palmcredit

Palmcredit offers attractive low-interest loans without collateral, with over 5 million downloads and a significant number of positive reviews.

Key Features:

- Loan Amount: Up to ₦100,000

- Interest Rate: 14% to 24%

- Tenure: 14 to 180 days

- APR: 48% to 56%

Application Process:

- Get the Palmcredit app by visiting the Google Play Store.

- Sign up with your phone number.

- Enter your details and verify your phone number.

- Apply for a loan and receive approval quickly.

- Choose the disbursement method (bank or mobile money).

4. Carbon

Carbon, licensed by CBN and insured by NDIC, offers loans up to ₦1,000,000 with cashback rewards for timely repayments. It has over 1 million downloads and positive user reviews.

Key Features:

- Loan Amount: Up to ₦1,000,000

- Interest Rate: 5% to 15%

- Tenure: 30 days to 12 months

Application Process:

- Download the Carbon app from their website or the Google Play Store.

- Create an account and provide accurate details.

- Request a loan and wait for approval.

- Receive funds in your account upon approval.

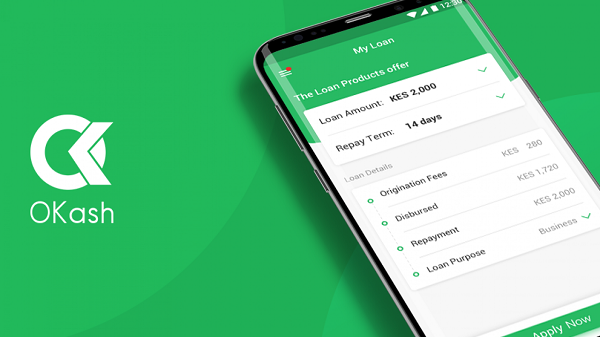

5. Okash

OKash provides loans without collateral, requiring only a source of monthly income. It has over 5 million downloads and offers convenient access to credit anytime, anywhere.

Key Features:

- Loan Amount: ₦3,000 to ₦500,000

- Interest Rate: 0.1% to 1% daily

- APR: 36.5% to 360%

- Tenure: 91 to 365 days

Application Process:

- Download the OKash app.

- Register and follow the instructions.

- Fill out your information accurately.

- Apply for a loan and receive approval via SMS.

- Funds are disbursed within five minutes of approval.

6. Aella Credit

Aella Credit offers instant loans, investments, and health insurance. With over 1 million downloads, it provides loans without collateral or late fees.

Key Features:

- Loan Amount: ₦2,000 to ₦1,000,000

- Interest Rate: 4% to 30%

- Tenure: Up to 3 months

Application Process:

- Download the Aella Credit app from the Apple App Store or Google Play Store.

- Create an account and provide accurate information.

- Check your eligibility and apply for the approved loan amount.

- Funds will be deposited into your bank account promptly

7. Quick Check

QuickCheck uses machine learning to predict borrower behavior and offers collateral-free loans. It has over 1 million downloads and provides loans based on eligibility.

Key Features:

- Loan Amount: ₦10,000 to ₦200,000

- Interest Rate: 2% to 30%

- Tenure: 4 weeks to 1 year

Application Process:

- Install the QuickCheck app from the Google Play Store

- Create a profile and provide accurate information.

- Determine your eligibility and submit a loan application.

- Receive funds in your wallet or bank account.

8. Umba

Umba operates in Nigeria and Kenya, offering loans without collateral. It has over 1 million downloads and provides higher loan amounts for timely repayments.

Key Features:

- Loan Amount: ₦3,000 to ₦300,000

- Interest Rate: 10%

- Tenure: Up to 62 days

Application Process:

- Download the Umba app from the Google Play Store.

- Sign up and register your information.

- Determine your eligibility and submit a loan application.

- Receive funds in your wallet or bank account.

9. Newcredit

Newcredit offers quick loans without collateral, with over 1 million downloads and numerous positive reviews.

Key Features:

- Loan Amount: ₦10,000 to ₦300,000

- Interest Rate: 4% monthly

- APR: 48%

- Tenure: 91 to 365 days

Application Process:

- Access the Newcredit app from the Google Play Store.

- Create an account and enter accurate information.

- Submit a loan application and await approval.

- Receive funds in your bank account within five minutes.

10. Ease Cash

Ease Cash provides reliable loans without collateral, with over 1 million downloads. It charges a one-time processing fee and offers a user-friendly application process.

Key Features:

- Loan Amount: ₦1,000 to ₦100,000

- APR: 14%

- Tenure: 91 to 180 days

Application Process:

- Download the Ease Cash app from the Google Play Store.

- Create an account and enter your basic information.

- Apply for a loan and receive approval.

- Funds will be transferred to your bank account promptly.

Conclusion

While these loan apps offer quick and easy access to funds without collateral, it’s essential to thoroughly review their terms and conditions before applying. Consider factors like interest rates and repayment periods to ensure you choose a loan that aligns with your financial capabilities. Always conduct your own research and consult with financial professionals when making loan decisions.

Disclaimer

This information is for general awareness and does not constitute financial advice. Always do your research and consult with a financial professional before making any financial decisions.