How To Get Urgent Loan 10,000 Naira In Nigeria

In Nigeria, obtaining a quick personal loan of ₦10,000 can be essential for handling urgent financial needs.

Various options are available, including online lenders, microfinance banks, and even some traditional banks. Among these, online lenders are often the fastest in disbursing loans, though they may come with higher costs.

Using platforms can help you compare and find the best loan rates available to you. This guide will provide an overview of potential lenders and important considerations when applying for a loan.

Top Lenders for ₦10,000 Loans

Renmoney

Renmoney is a well-established and reputable lender with a solid and good reputation. They offer a hassle-free loan process without requiring collateral, paperwork, or guarantors, making it quick and easy to get a loan.

Page Financials

Page Financials is another reliable online lender known for its quick loan disbursement, promising to deliver funds within three hours. Their repayment terms are straightforward and convenient.

Zitra Investments

Zitra Investments, though relatively new, has a management team with extensive experience in finance. They offer instant cash loans with competitive rates, making them a viable option.

How To Get ₦10,000 Loan

Research Lenders

Start by identifying potential lenders who can provide you with the loan. Look for loan providers with favorable terms, competitive interest rates, and a good reputation.

Apply Online

Most lenders have an online application process. Carefully fill out all the necessary personal details and submit any required documents promptly.

Review Offers

If approved, review the loan offers presented to you. Thoroughly compare interest rates, repayment terms, and other important conditions.

Accept and Receive Funds

Once you’ve chosen the best loan offer, accept it. The funds will typically be disbursed to your bank account within a relatively short period.

Cost of a ₦10,000 Loan

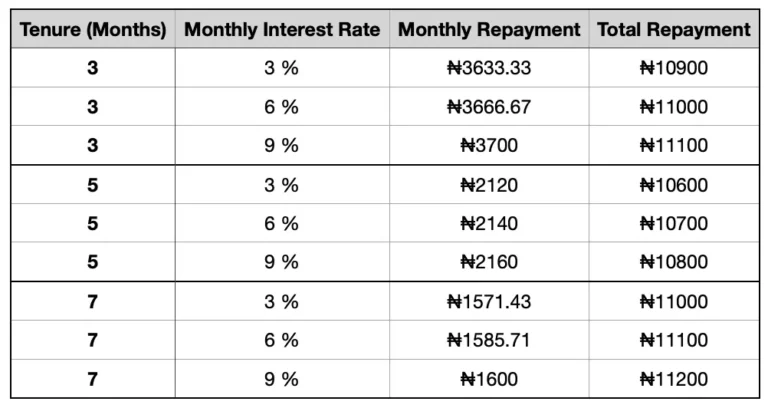

The cost of a ₦10,000 personal loan depends on the interest rate, loan tenure, and any additional fees charged by the lender.

For instance, a ₦10,000 loan with a monthly interest rate of 5% over three months will result in a total repayment amount of ₦11,500, excluding other fees. Understanding these costs upfront is crucial to ensure timely repayment.

₦10,000 Loan Calculator

Use a loan calculator to determine the exact cost of your loan based on the interest rate and repayment period. This will help you plan your finances better and avoid any surprises.

Pros and Cons of a ₦10,000 Loan

Pros

- Quick Access to Funds: Small loans like ₦10,000 are usually processed faster, providing immediate financial relief.

- No Collateral Required: Many ₦10,000 loans are unsecured, meaning you don’t need to provide any assets as security.

- Short Repayment Period: These loans often have shorter repayment terms, ensuring you’re not in debt for a long time.

Cons

- Higher Interest Rates: Smaller loans may come with higher interest rates compared to larger loans.

- Risk of Over-reliance: Easy access to such loans might lead to habitual borrowing, which can cause financial strain.

- Hidden Charges: Some lenders might have hidden fees or terms that can increase the overall cost of the loan.

Frequently Asked Questions About ₦10,000 Loans

How Hard Is It to Get a ₦10,000 Loan?

Getting a ₦10,000 loan is generally easier than obtaining larger loan amounts. Many online lenders, microfinance banks, and some traditional banks offer small-scale loans. The ease of obtaining the loan depends on your credit history, existing financial obligations, and the specific requirements of the lender.

How Can I Get a Quick ₦10,000 Loan?

To get a quick ₦10,000 loan, online lenders and loan apps are usually your best options. Using platforms like Credit Nigeria can help you find the most suitable and affordable loan options available to you.

Can I get a ₦10,000 loan if I am currently unemployed?

It is possible to get a ₦10,000 loan even if you are unemployed. Some lenders might consider alternative sources of income, such as regular remittances, rental income, or profits from a small business. However, the interest rates may be higher, and the terms might be stricter for unemployed individuals seeking loans.

Important Considerations

- Beware of Fraudulent Offers: Be cautious of fraudulent loan offers circulating via email, social media, and online job boards. These scams often involve fraudulent requests for upfront payment or sensitive personal information. Always verify the legitimacy of the lender before providing any personal details or agreeing to any terms.

- No Upfront Fees: Reputable lenders should not charge upfront fees for loan applications. If a lender asks for payment before processing your loan, it is likely a scam. Always ensure that the lender follows transparent practices and does not impose hidden charges

Conclusion

Getting an urgent ₦10,000 loan in Nigeria is manageable if you know where to look and how to apply. By researching potential lenders, comparing loan offers, and understanding the costs involved, you can secure the funds you need quickly and efficiently.

Remember to consider the pros and cons and be cautious of fraudulent offers to ensure a safe borrowing experience.