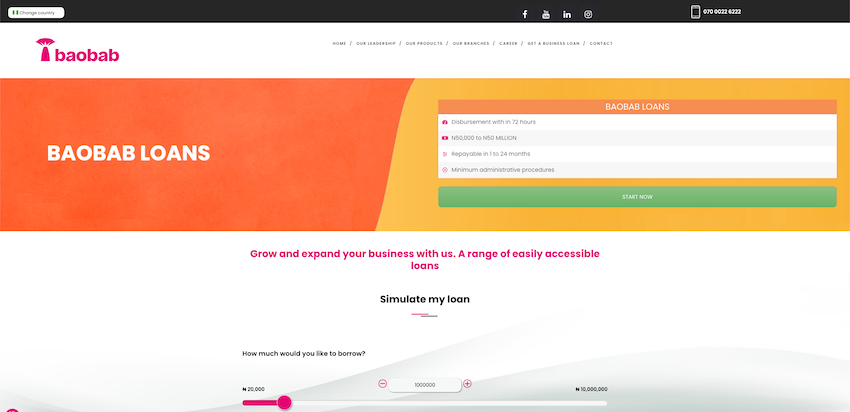

When it comes to securing financial assistance for your business in Nigeria, Baobab Loan stands out as a notable option. They provide a variety of loan products designed to meet the financial needs of both individuals and businesses. Whether you are looking to start a new venture, expand an existing business, or need funds for personal expenses, Baobab Loan has options that could suit your requirements.

Why Choose Baobab Loan?

Baobab Loan is well-known across Nigeria for its accessibility and flexibility. They provide loans up to N150 million and have branches in multiple states to ensure they are within reach for most Nigerians. What makes the Loan stand out is their wide selection of loan products, including choices like asset financing. This makes it easier for business owners to find the right type of loan for their specific situation.

Meeting the Requirements

Before you can secure a loan with Baobab, you need to meet certain criteria. Key among these are the need for collateral and guarantors. Collateral could be any valuable asset, such as property or vehicles, which you pledge as security for the loan. Guarantors are people who promise to cover your loan if you can’t repay it, vouching for your ability to meet the repayment terms.

Starting the Loan Application Process

To start the loan application process, you need to visit a Baobab office. Here, you can consult with knowledgeable staff who will guide you through the different loan options available and help you with your application. Baobab prides itself on a transparent and straightforward application process, ensuring that all customers fully understand the terms and conditions of their loans.

Empowering Individuals and Businesses

The primary aim of Baobab Loan is to enable both individuals and businesses to achieve their goals by offering essential financial support. Whether you need funding for a new project, investment in assets, or support during difficult times, Baobab is dedicated to helping you meet your financial needs.

Key Requirements for Baobab Loans

To apply for a loan with Baobab, you need to provide several documents and meet certain conditions:

- Collateral: You must offer valuable assets as security for the loan.

- Guarantors: Two individuals need to vouch for your ability to repay the loan.

- Residency: You must reside in one of the 16 states where Baobab operates.

- Business Ownership: Your business should be registered and operational.

- Credit History: A solid credit history can boost your chances of getting your loan approved.

Types of Loans Offered by Baobab

Baobab Nigeria provides a variety of loan products to cater to the different needs of business owners:

- Micro Loan: For small businesses needing between N1,000,000 and N2,000,000. The loan term is from 6 to 18 months.

- SME Loan: For bigger businesses needing anywhere from N1,000,000 to N150,000,000, with repayment periods between 6 to 24 months.

- Guarantee Loan: Ranging from N50,000 to N50,000,000, these loans are available for terms starting from 6 months.

- Asset Finance: Loans designed for purchasing assets, with repayment terms ranging from 6 to 18 months.

- Building Loan: For construction purposes, with terms ranging from 6 to 24 months.

- Green Loan: Aimed at existing customers and business owners, offering up to N150,000,000 for 6 to 24 months.

How To Apply For Baobab Loan

Here’s a simplified guide on how to apply for a loan with Baobab:

- Check Your Eligibility: Ensure you have an existing business and operate within Baobab’s lending areas.

- Visit a Branch: Pick up an application form from the nearest Baobab office.

- Complete the Application: Fill out the form and submit it along with necessary documents like passport photographs, a valid ID card, utility bills, and your BVN.

- Upload Documents: Adhere to the guidelines on the portal to submit your necessary credentials.

- Review Your Application: Double-check for any errors before submitting it.

Interest Rates and Fees

Baobab offers competitive interest rates that vary depending on the loan amount. Notably, there are no hidden fees or mandatory account openings required before securing a loan.

The Journey of Baobab Loan

Baobab Loan, led by CEO Philip Sigwart, has been serving Nigerians since 2018. Though officially a microfinance bank, their primary focus is on providing loans. Their journey began in 2005, and since then, they have grown significantly, establishing branches in 16 states across Nigeria.

With over 200,000 individuals benefiting from their loans, Baobab Loan has become a popular choice for many Nigerians. They have stuck to their core expertise of offering loans, becoming specialists in this area and providing various loan types to meet everyone’s needs.

Making a Positive Impact

Baobab Loan is dedicated to helping Nigerians achieve their goals by providing the financial support they require. This helps not just individuals but also plays a significant role in boosting the country’s economy. Despite being relatively young in the banking world, Baobab Loan is making a significant impact and promises to continue supporting Nigerians in their financial endeavors.

Conclusion

In conclusion, Baobab Loan provides a reliable and accessible option for business owners and individuals in Nigeria looking for financial support. With a variety of loan products, a straightforward application process, and competitive interest rates, Baobab Loan is well-positioned to help you achieve your financial goals. Whether you need funds to start a new business, expand an existing one, or cover personal expenses, Baobab is dedicated to supporting your financial needs and helping you succeed.

ALSO READ: How To Get Up To N5 Million Loan For Your Business In Nigeria