10 Top Loan Apps In Nigeria 2024

In Nigeria, loan apps have become vital for many, especially within the informal economy. They provide quick, easy loans despite some controversy surrounding their practices, particularly in debt recovery.

The Federal Competition and Consumer Protection Commission (FCCPC) acknowledges the necessity of these apps, noting that banning them would leave many Nigerians without a crucial financial resource.

Despite complaints about harassment and unethical practices, several loan apps adhere to ethical standards set by the FCCPC and other regulatory bodies like the Nigerian Communications Commission (NCC), the Central Bank of Nigeria (CBN), and the Economic and Financial Crimes Commission (EFCC).

There are over 200 approved loan apps, and their performance is often reflected in user ratings and reviews on the Google Play Store.

Top Loan Apps In Nigeria

Here are the top 10 loan apps in Nigeria as of January 2024, based on user ratings:

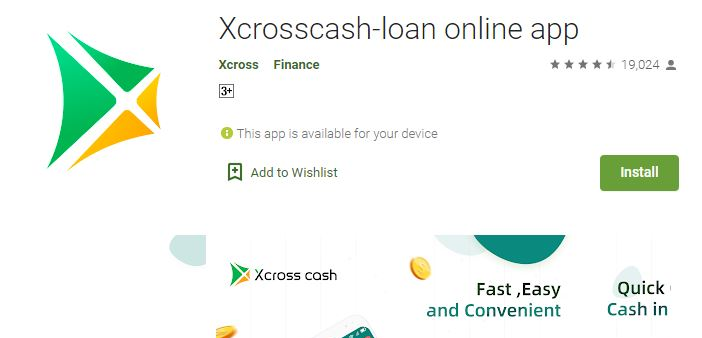

10. Xcrosscash (4.0)

Xcrosscash offers instant loans ranging from N10,000 to N50,000, with repayment plans from 91 to 180 days. Despite having one of the lowest loan ranges, it boasts a high user rating. It has been downloaded over 1 million times and has a 4.0 rating from 32,846 users.

9. Renmoney (4.1)

Renmoney, a microfinance bank, provides personal and small business loans from N50,000 to N6 million, and is known for its customer-friendly services. It boasts over 1 million downloads and has a 4.1 rating from 22,687 users. The app is praised for its user-friendly interface and reliable service.

8. Newcredit (4.1)

Operated by Newedge Finance Limited, Newcredit provides instant, collateral-free loans ranging from N10,000 to N300,000 with repayment plans of 91 to 365 days. Utilizing AI to assess creditworthiness, it is one of the most popular loan apps with over 5 million downloads and a 4.1 rating from 65,763 users.

7. Palm Credit (4.2)

Also owned by Newedge Finance Limited, Palmcredit offers instant, collateral-free loans. This app is among the most popular in Nigeria, with more than 10 million downloads and a 4.2 rating from 173,017 users. The app is favored for its ease of use and quick loan disbursement.

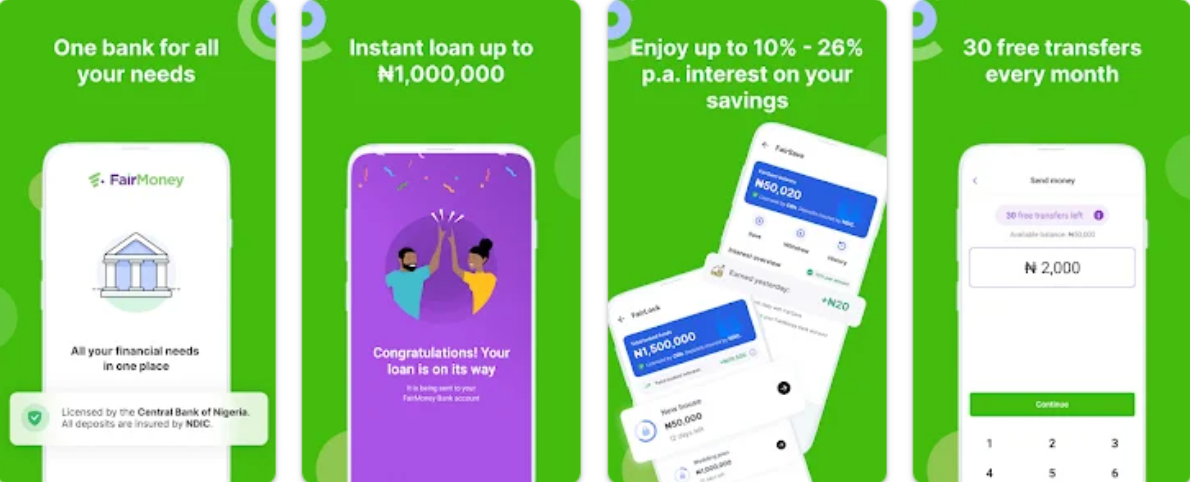

6. FairMoney (4.2)

FairMoney operates as a digital bank, offering loans up to one million naira, alongside bank accounts and debit cards. It processes over 10,000 loans daily, reflected in its over 10 million downloads and a 4.2 rating from 587,808 users. The app is praised for its comprehensive banking features and reliable loan services.

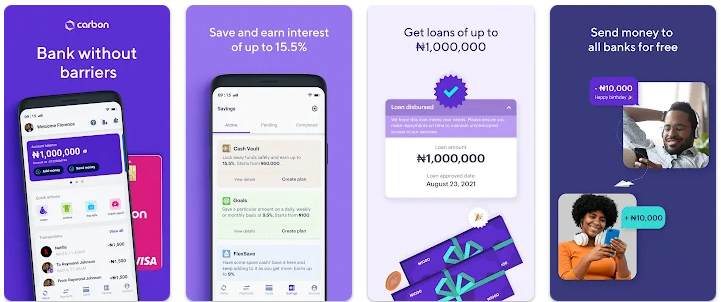

5. Carbon (4.3)

Carbon is a CBN-licensed digital bank that provides loans, investment opportunities, and typical banking features like debit cards. With over 1 million downloads, it has a 4.3 rating from 158,270 users. The application is praised for its smooth user experience and wide range of financial offerings.

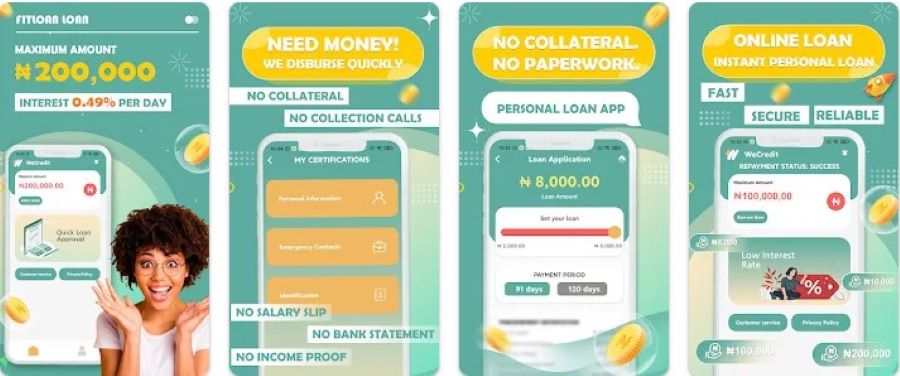

4. Wecredit (4.4)

Wecredit provides loans from N10,000 to N200,000 with an Annual Percentage Rate (APR) ranging from 10% to 30%. It has been downloaded over 1 million times and is rated 4.4 by 32,650 users. The app is appreciated for its straightforward loan application process and competitive interest rates.

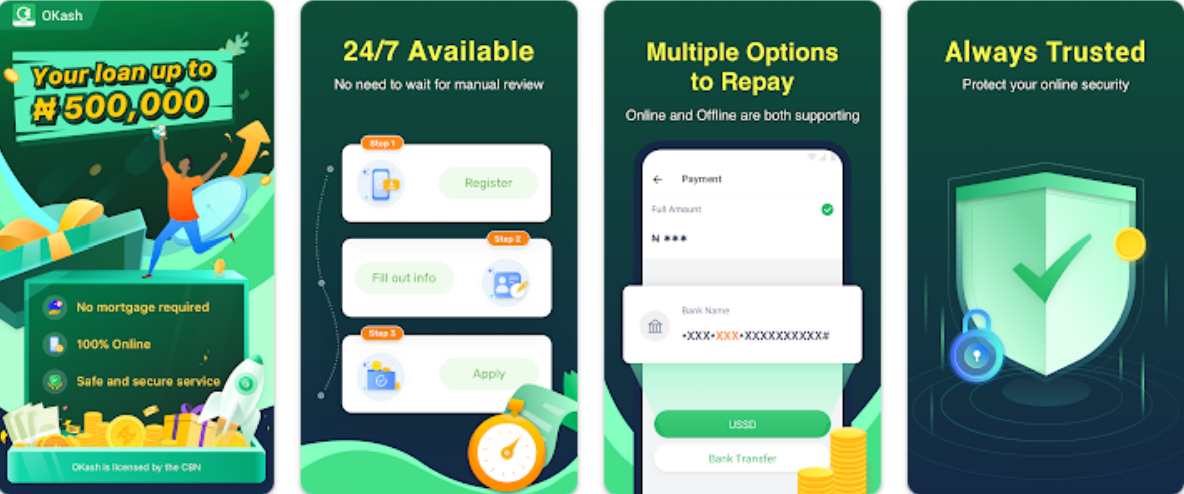

3. OKash (4.5)

Managed by Blue Ridge Microfinance Bank Limited, OKash offers loans ranging from N3,000 to N500,000, with repayment terms spanning from 91 to 365 days. It has surpassed 5 million downloads and has a 4.5 rating from 198,000 users. Users commend its minimal documentation requirement and quick loan disbursement.

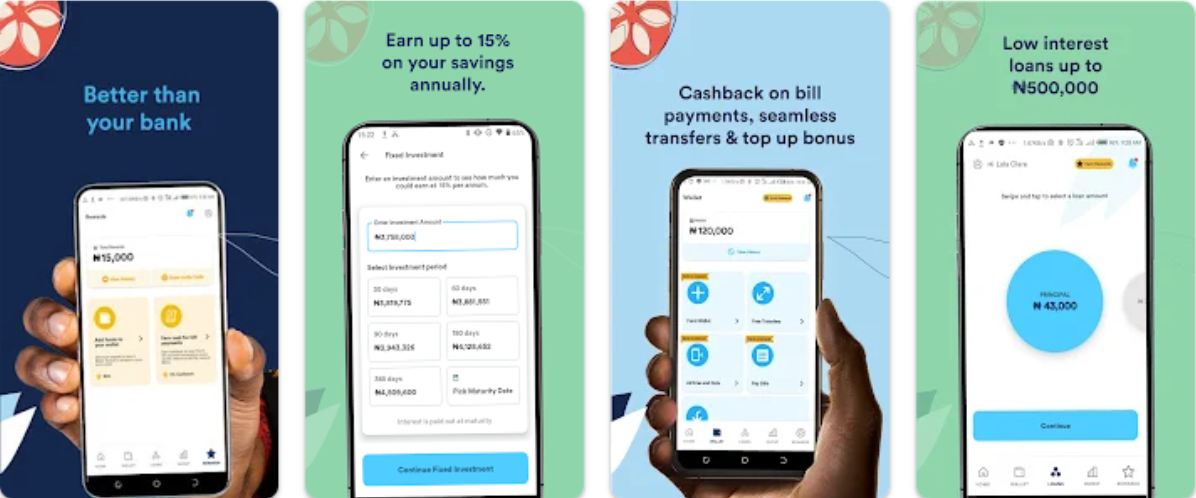

2. EasiMoni (4.5)

EasiMoni, also managed by Blue Ridge Microfinance Bank, provides loans from N3,000 to N1 million with monthly interest rates between 5% and 10%. Boasting over 5 million downloads, it maintains a 4.5 rating from 222,145 users. The app is favored for its transparent loan terms and efficient service.

1. Branch (4.5)

Branch is one of the most widely used loan apps in Nigeria, with a presence in multiple countries. It has over 10 million downloads and a 4.5 rating from 1.3 million users. Branch offers loans from N2,000 to N1,000,000, with a repayment period of 4 to 40 weeks and interest rates ranging from 17% to 40%. The app uses smartphone data to determine loan eligibility and provides quick loan access, usually within 12 hours.

Understanding Loan Apps in Nigeria

The key is to grasp the subtleties of ghostwriting and learn how to market yourself effectively in this niche. Digital lenders have become a lifeline for many Nigerians, providing essential financial services that traditional banks often cannot. Despite regulatory challenges, these apps continue to thrive, offering various loan amounts and repayment terms to suit different needs.

Key Factors for Loan App Success

- Interpersonal Skills: As a ghostwriter, you’ll need to collaborate closely with your clients to fully grasp their vision, preferences, and target audience.

- Seek Feedback: Don’t hesitate to share your work with others and welcome constructive criticism to improve.

- Adaptability: Be prepared to tailor your writing style to fit the diverse needs of different clients.

Regulatory Framework

The FCCPC, along with other regulatory bodies, has established guidelines to ensure ethical practices among digital lenders. This includes the Limited Interim Regulatory/Registration Framework and the 2022 Guidelines for Digital Lending. Compliance with these standards is crucial for loan apps to operate legitimately and maintain user trust.

The Role of User Reviews

User ratings and reviews on platforms like Google Play Store are essential indicators of an app’s reliability and user satisfaction. Apps with higher ratings typically offer better user experiences, including prompt loan disbursement, transparent terms, and responsive customer service.