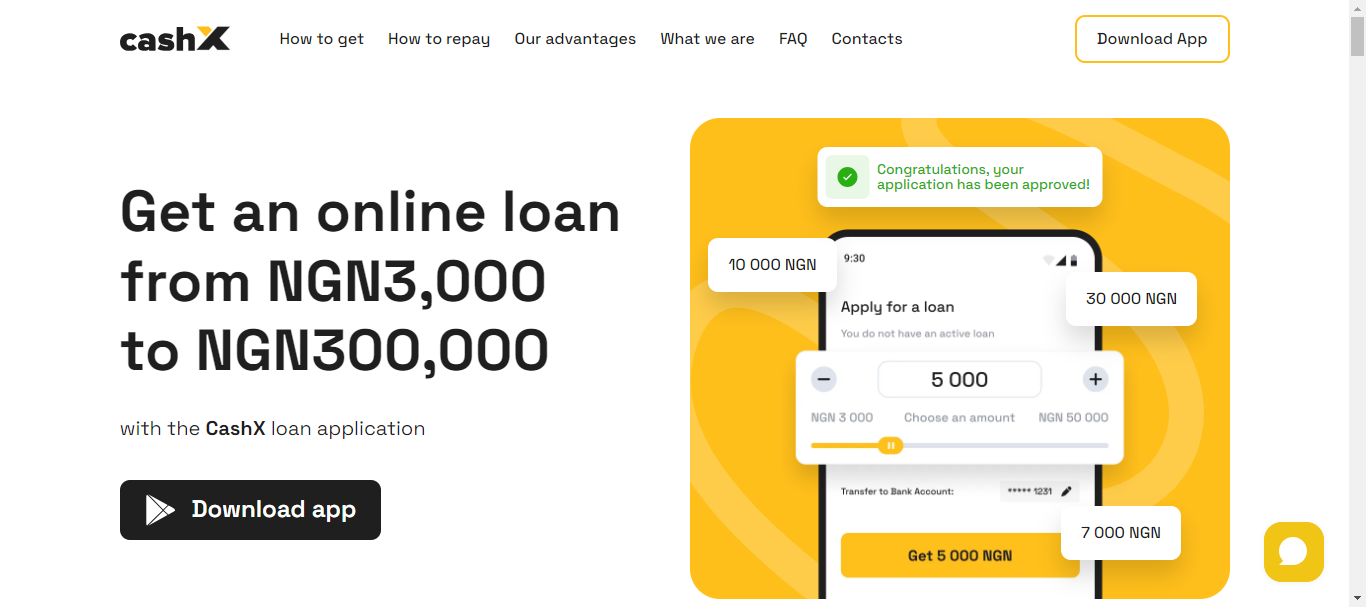

CashX Loan App: How To Borrow From NGN3,000 To NGN300,000 In Nigeria

In Nigeria’s rapidly evolving financial technology (fintech) landscape, digital loan platforms are gaining widespread popularity, providing quick and convenient loans to millions of Nigerians. Among these emerging services is the CashX Loan App, a mobile-based platform designed to offer instant loans with minimal documentation and hassle. As the demand for short-term, no-collateral loans grows, CashX positions itself as a convenient solution for Nigerians in need of emergency funds, providing access to loans that can be applied for and approved within minutes.

What is CashX Loan App?

CashX is a mobile app that provides instant loans to individuals and small business owners in Nigeria. Like many other fintech platforms in the country, CashX operates by leveraging data analytics and artificial intelligence to assess creditworthiness, making it easier for users to access funds without having to go through traditional banks. It is targeted at a wide range of users, including salary earners, small entrepreneurs, and individuals looking for fast access to funds to cover unexpected expenses or urgent needs.

Key Features of CashX Loan App

- Instant Loans: One of the main attractions of the CashX Loan App is its ability to disburse loans almost immediately after approval. Users can apply for loans and receive them in their bank accounts within minutes, making it ideal for emergencies.

- No Collateral Required: CashX, like other digital lending platforms, eliminates the need for collateral, which is often a significant barrier in traditional lending systems. This makes it accessible to a broader population, especially individuals who may not own assets but need quick access to cash.

- Flexible Loan Amounts: CashX offers a range of loan amounts depending on the user’s credit profile. The more reliable a borrower’s credit history, the higher the potential loan amount. Typically, users can borrow amounts between ₦5,000 and ₦200,000, although the loan limit may vary based on an individual’s credit score and history.

- Transparent Interest Rates: The app provides users with transparent and upfront interest rates before they commit to taking out a loan. Interest rates can range between 15% to 30%, depending on the loan amount and repayment tenure. It is essential for borrowers to thoroughly review the terms to avoid defaulting or accruing unnecessary charges.

- Simple Repayment Process: Repaying a loan on the CashX platform is straightforward. Users can set up automatic deductions from their bank accounts, or manually repay through the app. Early repayment options are also available, which can help borrowers avoid additional interest fees.

How to Apply for CashX Loan

Getting a loan through CashX is simple and can be done right within the app. Here’s a step-by-step guide:

- Download the App: CashX can be found on the Google Play Store for Android users. After downloading it, all you need to do is set up an account.

- Complete Registration: New users must provide personal details such as name, phone number, email address, and Bank Verification Number (BVN). The app uses this information to verify the applicant’s identity and creditworthiness.

- Apply for a Loan: Once you’ve registered, you can go ahead and submit your loan application. They select the loan amount and repayment period that suits their needs. The app will show the interest rate and repayment schedule before submission.

- Loan Approval: CashX uses its algorithm to assess the borrower’s risk and determine whether the loan will be approved. Usually, the whole process only takes a few minutes to complete.

- Receive Funds: If approved, the loan amount is deposited directly into the borrower’s bank account within minutes.

Benefits of Using CashX Loan App

- Quick Access to Funds: CashX provides an efficient way for individuals to get quick access to funds, especially in emergency situations.

- User-Friendly Interface: The app is designed to be simple and user-friendly, making it easy for anyone to navigate through the loan application process.

- No Need for Collateral: The absence of collateral requirements makes it more accessible to a wider audience, including individuals who may not have assets to secure traditional loans.

- Flexible Loan Terms: With flexible loan amounts and repayment terms, users can choose what works best for them, ensuring that they can manage their finances without overextending themselves.

- Improved Financial Inclusion: CashX contributes to the broader goal of financial inclusion by offering loans to individuals who may otherwise be excluded from the formal banking system due to a lack of credit history or collateral.

Challenges and Considerations

While the CashX Loan App offers many benefits, users should be mindful of a few challenges:

- High Interest Rates: Like many digital loan platforms, CashX may charge higher interest rates compared to traditional banks, particularly for short-term loans. Borrowers should carefully review the rates to avoid falling into debt traps.

- Strict Repayment Terms: Missing a repayment deadline can result in penalties, higher interest rates, or even damage to the user’s credit score. Users must ensure they can meet the repayment terms before borrowing.

- Data Privacy: With the app accessing sensitive personal information like BVN and bank details, it is crucial for users to understand the privacy and data security policies of CashX to safeguard their financial data.

Conclusion

The CashX Loan App has emerged as a valuable tool for individuals in Nigeria seeking quick, short-term loans without the complexities of traditional bank lending. With features such as instant approval, no collateral, and a user-friendly platform, it has carved out a niche in the country’s fintech landscape. However, like all financial products, potential borrowers should carefully evaluate the terms and ensure they can meet repayment obligations to fully benefit from the service.

ALSO READ: How To Apply For Letshego Loan In Nigeria