Cashfarm Loan App: Borrow Urgent N50,000 In Nigeria

The development of contemporary society means that citizens require fast ways of finding financial assistance in cases of emergencies. Sometimes, an individual realizes an emergency bill is due or is short of cash on hand, and having a simple loan to get through it will help.

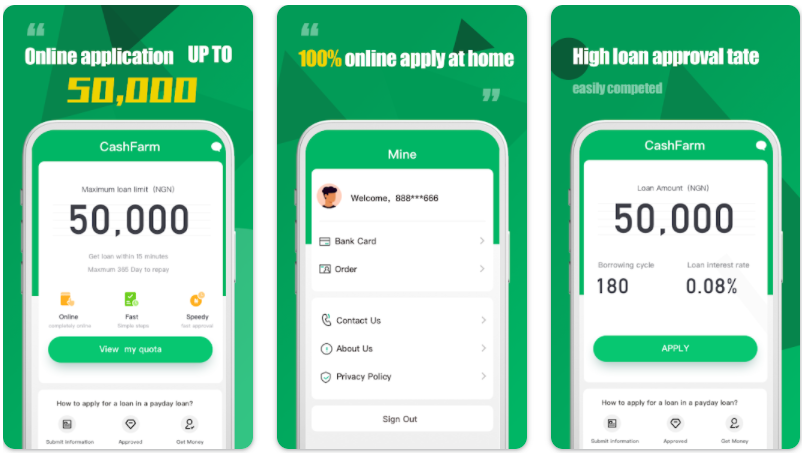

The Cashfarm loan app is meant to offer small amounts of money for short terms without such formalities as documentation or long processes. In this article, we will give you detailed information on how you can borrow a loan using the Cashfarm app.

Getting Started With Cashfarm Loan App

The first step to gaining access to a loan from Cashfarm is opening an account with the mobile application. It is available at the Google Play Store or Apple’s App Store for smartphones and other Android devices. If you have not downloaded the app yet, then first download it and install it on the device you want, then launch the application. At this point, the Cashfarm loan app will ask for account details if you are a first-time user. This process takes a short while; they only need your name, email address, phone number, or any other contact details that you may provide.

Following that, the app will explain how you can pass the identity verification stage, which is critical for applicants who want to meet the loan requirements of the app. Additionally, the app will ask you to fill in your home address and details about your employment and income. Do not fret; the interface is developed in such a way that it guides the user through different sections to help create a smooth process.

Setting Up Your Profile

After creating an account, it is now time to set up your profile, as it will serve as your foundation. This part requires additional data about yourself. While using Cashfarm, you will need to provide details so that the loan can be approved and the maximum loan amount can be determined. They will request your National Identification Number (NIN) or another identification card. Always remember to cross-check all the data you provide to avoid mistakes that may cause delays in the approval of the loan.

One key element of this stage is linking your bank account. The Cashfarm loan app needs your bank information to deposit your loan once approved and to handle repayments. Make sure the account you link is active and in your name. This process is secure, and Cashfarm uses encryption to ensure your banking details remain safe.

Checking Loan Eligibility

With your profile set up, the next step is determining your eligibility for a loan. Cashfarm loan app uses an algorithm to assess your creditworthiness based on the details you provided. Factors like your income, employment status, and credit history (if applicable) will be evaluated. If you’re a first-time borrower, you may be offered a smaller loan to start with, but as you successfully repay loans on time, your borrowing limit may increase.

One important thing to note is that Cashfarm, like many other loan apps, considers your repayment history and financial discipline. If you maintain a good track record, you’ll find it easier to borrow larger sums in the future. But if you’ve had trouble with past loans, this could impact the amount you can borrow.

Applying for a Loan

Now comes the crucial part: applying for the loan itself. From the app’s home screen, navigate to the “Loan” section, where you’ll be shown a variety of loan options. These options will display your borrowing limit, interest rates, and repayment terms. It’s essential to review these details carefully to understand what you’re committing to.

Once you’ve decided on the loan amount that fits your needs, simply click the “Apply” button. The Cashfarm loan app will then process your request and give you an estimated approval time. Usually, this happens quickly, especially if all your documentation is in order. Keep an eye on your phone for updates, as you’ll be notified once the loan has been approved.

Loan Disbursement

After the loan approval, Cashfarm will automatically deposit the requested amount into your linked bank account. This process is usually fast, often within minutes, but in some cases, it can take up to 24 hours. If there’s any delay, ensure that all your bank details are correct and reach out to Cashfarm’s customer support for assistance.

Repayment Terms and Conditions

One of the most important aspects of borrowing from the Cashfarm loan app is understanding the repayment terms. These loans are typically short-term, meaning you’ll need to repay the loan in a relatively brief period, often within 30 days. Interest rates can vary, so it’s wise to calculate how much you’ll owe before accepting the loan. This helps you avoid any surprises when it’s time to repay.

Below are the various methods approved by Cashfarm for repaying the amounts more easily. You can set up automatic deductions from your bank account, ensuring you don’t miss a payment. The second option is to manually repay through the app, and the selection of repayment options is much more limited. Remember that on-time payment is required to avoid penalties and to maintain or enhance one’s creditworthiness within the specified application, making it easier to secure further loans.

Defaulting and Penalties

Taking a loan from Cashfarm is very easy, and hence, it is very important that one be in a position to pay back the loan with interest. If you are unable to pay for your loan according to the terms, then there are penalties, such as extra charges on interest or a negative impact on your credit history. This may affect your creditworthiness and future borrowing, not only with Cashfarm but across the board.

In some cases, if you’re unable to meet your repayment deadline, the app may offer an option to extend the loan. Make sure you review the details of this extension because it means increased interest costs. In such a scenario, it is advisable to reach out to Cashfarm’s customer care and negotiate, as it is unwise to reverse the charges.

In conclusion, applying for a loan via the Cashfarm app is very easy and does not take a long time. After registering your profile and providing personal data, everything is completed through the smartphone, eliminating the need for additional paperwork. Just ensure that you go through all the requirements and details, such as the terms and conditions of the loan and how the repayment will be handled, among others, so that you take a responsible loan. Thus, you can make the most out of the Cashfarm app while avoiding the pitfalls that come with borrowing money.

ALSO READ: How To Apply For FCMB FastCash Loan | Borrow Up To N200,000 Without Collateral