BG Loan App: Borrow Up To N500,000 In Nigeria

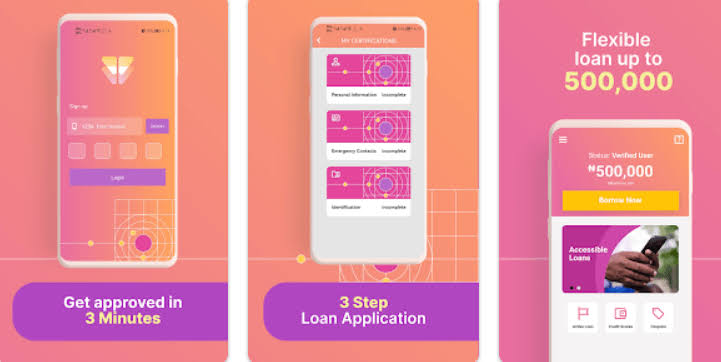

When it comes to requiring quick financial help for business financing or handling unintended costs, the BG Loan App is an option. Whether you are a small business looking to expand or just need some extra cash in your pocket, BG loan makes it easy for anyone to access loans without going through all the hassles involved in traditional banking systems.

Let’s discuss what you need to know before applying for a loan through the BG Loan App, including the requirements and benefits.

Understanding the BG Loan App

The BG Loan App which is Balogun Gambari Loan App is a digital credit hub developed to provide loan services to Nigerians which are fast and easily accessible. It has an intuitive interface, interest rates that are friendly, and swift approvals when requesting loans.

Individuals and businesses are both catered for in this application; therefore, one can receive funding between ₦10,000 and over ₦1,000,000 as per their needs and eligibility.

One of the main features about the BG Loan App is that there is no need for collateral. Many people looking for loans conceive the idea that they have to put up their property, but this platform has made it clear this requirement is not necessary because meeting other criteria is more important here than anything else. Besides, your information should be correct in order to verify it before getting any loan.

How BG Loan App Works

Before going straight into the money application process let’s start by understanding how exactly does this work? Here’s a simplified breakdown:

- Check Eligibility: The first step is to determine whether you meet the basic eligibility requirements. These include being of a certain age, having a valid identification, and maintaining a good credit score. Missing out on any of these could result in your application being rejected.

- Application Process: During the application, you’ll need to provide key personal details, including your Bank Verification Number (BVN). The BVN is crucial as it helps the platform assess your creditworthiness, which is basically a measure of how likely you are to repay the loan based on your financial history.

- Credit Score Evaluation: The app will evaluate your credit score to determine the amount of loan you’re eligible for. A higher credit score increases your chances of getting the loan amount you need, so it’s advisable to manage your financial obligations responsibly before applying.

- Loan Approval: If your application meets all the criteria, and your credit score is satisfactory, the loan is quickly approved and disbursed into your bank account. This process is known for being fast, often taking just a few minutes from application to approval.

Eligibility Requirements for a BG Loan

Before applying, it’s crucial to ensure that you meet the following requirements:

- Age Requirement: You must be between the ages of 18 and 60 to qualify for a BG loan. This ensures that applicants are legally able to enter into a contract and have the potential to repay the loan within the given timeframe.

- Nigerian Citizenship: The loan is only available to Nigerian citizens. Unfortunately, non-citizens are not eligible to apply.

- High Credit Score: Having a strong credit score is key—it’s one of the main factors that determine whether your loan gets approved. A higher credit score indicates good financial behavior and increases your chances of getting the loan approved. If your credit score is low due to unpaid debts or defaults, it might be challenging to secure a loan through this platform.

- Accurate Documentation: You’ll need to provide all necessary documentation accurately. This includes personal identification details and your BVN, which will be used to verify your identity and assess your loan eligibility.

Key Benefits of Using BG Loan App

The BG Loan App offers several advantages that make it an appealing choice for those in need of quick financial assistance:

- Fast Approval and Disbursement: One of the most significant benefits of the BG Loan App is its quick loan approval process. If you meet all the requirements, your loan can be approved, and the funds disbursed to your account in just a matter of minutes.

- No Collateral Required: Unlike traditional loans that often require valuable assets as collateral, the BG Loan App does not demand any form of collateral. This makes it easier for individuals and small businesses, who may not have significant assets, to access the funds they need.

- Low-Interest Rates: The interest rates on loans provided through the BG Loan App are relatively low, typically ranging between 3% to 5% per year. This affordability makes it easier for borrowers to repay their loans without falling into financial difficulties.

- Easy Application Process: The loan application process on the BG Loan App is designed to be user-friendly and straightforward. The entire process, from downloading the app to receiving your loan, can be completed within minutes, with minimal paperwork involved.

- No Paperwork or Physical Visits: Everything is done online, eliminating the need for tedious paperwork or trips to a physical office. This makes it convenient for people to apply from the comfort of their homes or offices.

Steps to Apply for a BG Loan

If you’re ready to apply for a loan through the BG Loan App, here’s how to get started:

- Download the App: First, go to the Google Play Store on your smartphone and search for the BG Loan App. Once you find it, click on “Install” to download the app to your device.

- Sign Up: Open the app and sign up by providing the necessary details. You’ll need to create an account using your phone number, email address, and other personal information.

- Complete Your Profile: Once you’ve signed up, the next step is to fill out your profile with all the necessary details. This includes entering your BVN, active phone number, and any other required information. Make sure all details are accurate to avoid delays in your application process.

- Apply for a Loan: Once your profile is complete, navigate to the loan application section. Select the loan amount you wish to borrow and choose a repayment plan that suits your financial situation. After that, submit your application.

- Loan Approval: If your application meets all the requirements, you’ll receive an approval notification within minutes, and the loan amount will be credited to your bank account.

How to Contact BG Loan

Should you need any assistance or have questions regarding your loan application, you can easily reach out to BG Loan’s customer support team. You can reach out to them through multiple support channels:

- Email: You can send your inquiries to info@balogungambarimfb.com.

- Phone: Alternatively, you can call their Contact Centre at 08166252204.

Frequently Asked Questions

Is BG Loan Legitimate? Yes, BG Loan is a legitimate lending platform. With over 100,000 downloads on the Google Play Store and a wealth of positive reviews, the app has built a solid user base. The app’s transparency and reliability have earned it a good reputation among users.

What Is the Interest Rate? The interest rate on BG loans is quite low, typically ranging from 3% to 5% per year. This makes it an affordable option for borrowers looking to avoid high-interest debt.

Conclusion

The BG Loan App is a reliable and convenient solution for Nigerians needing quick financial support. Whether you’re dealing with an emergency or looking to expand your business, this platform provides a simple, fast, and affordable way to get the funds you need. With its easy application process, no collateral requirement, and low-interest rates, BG Loan stands out as a valuable tool for managing your financial needs. So, if you ever find yourself in need of a loan, the BG Loan App might just be the perfect solution for you.

ALSO READ: How To Apply For Baobab Loan For Your Business In Nigeria